How much does a bookkeeper cost? Bookkeeper quotes and hourly rates explained.

The cost of a bookkeeper is largely dependent on the size of your business, the scale of the operations and how you choose to pay for the bookkeeper. In this article, we outline bookkeeping costs in detail, your hiring or outsourcing options and discuss what a bookkeeper can contribute to your business.

Want to compare bookkeeper costs in your local area? Fill out the form below and compare quotes from local bookkeepers in your area - for free! Time to complete: 15 seconds.

Firstly, what is the role of a bookkeeper for a small business?

A bookkeeper’s main responsibility is to produce data about the financial activities of the business. These activities include recording purchases, sales, receipts and payments made by the company. Keeping track of entries, debits and credits as well as generating and maintaining financial reports. Some other duties a bookkeeper does for small business include:

- Performing stock take

- Sending out invoices and managing accounts receivable

- Handling foreign exchange transactions

- Making sure the business is aligned with applicable laws

- Managing cash flow by keeping an eye on the balance of revenue to expenses

- Assisting CFO/Controller by analysing accounts, preparing work papers for month-end closing, scanning and attaching financial documents as well as generating Client Source Documents (PBCs) for tax and audit support

Find out how much it'll cost to outsource your bookkeeping

Get a more accurate, no-obligation quote by filling in this form.

1. Tell us which bookkeeping service you're looking for

What do you need help with? Payroll, cloud accounting or general bookkeeping?

2. Tell us where your company is based

We can put you in touch with local or national businesses, depending on your preference.

3. Compare bookkeeping costs

We'll put you in touch with trusted local companies and freelancers who will provide you with no-obligation quotes.

Is it expensive to maintain a bookkeeping service every month?

The answer to that is, it depends. Many factors dictate the cost a small-scale enterprise pays for its bookkeeping services. Key considerations include the size and life cycle of the company, amount of monthly transactions and employees, payroll management, number of company expenses and balance sheet reconciliation.

In their infancy, most small-scale enterprises would only really need basic bookkeeping activities such as payroll processing, making bill payments and abiding by regulations set out by the government or companies house. Having done the basic bookkeeping right, the business will then begin to focus on streamlining its accounting processes, placing importance on accurate financial reporting. This calls for the need of a more sophisticated bookkeeping practice, one that stems from cost management or accrual-based accounting, for the business to make well-informed decisions based on facts provided by advanced bookkeeping data.

How much does a bookkeeper cost? Bookkeeper quotes and hourly rates explained.

Do you need bookkeeping or accounting services?

Before you decide on either Basic Bookkeeping or Full-Service Accounting, it is important to ask yourself if your business requires just basic accounting compliance or if you need a more comprehensive service. Full-Service Accounting requires more effort and a higher level of expertise, so naturally, it would cost more to implement as opposed to basic bookkeeping. Having said that, the majority of companies that make the step up from basic bookkeeping to full scale accounting experience an exponential rise in their return on investment - a good accountant can make you money!

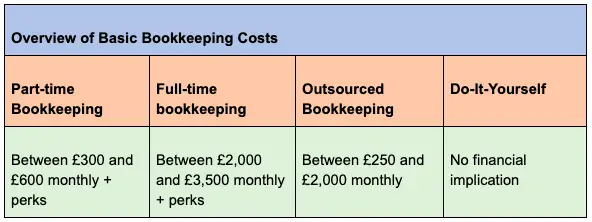

Basic Bookkeeping Costs at a Glance

Should you decide that all your company requires is basic bookkeeping at this stage of your business you can choose either to have the bookkeeping done internally or to outsource it altogether. If a decision is made to hire an in-house bookkeeper, your business would then have to determine if the role would be part-time or full-time. On the other hand, if your business decides to outsource its bookkeeping function, you can look to secure localized virtual bookkeeping services, acquire bookkeeping services of local CPA or bookkeeping companies. Here is a cost comparison of the aforementioned bookkeeping services:

The Cost of Part-Time Bookkeeping for Small-Scale to Medium-Sized Enterprises

The part-time bookkeeping rate charged by bookkeepers varies according to location and job scope. Most part-time bookkeepers charge an average rate of around £20 per hour for performing general bookkeeping duties and their job functions are usually overseen by the company hierarchy. It is a good idea to supplement your accounting activities to a part-time bookkeeping worker if you have a basic working knowledge of accounting as it helps in alleviating some of the mundane tasks of data entry into accounting ledgers, recording business transactions, processing vendors’ invoices and collecting payments from customers. As mentioned earlier, management would also have to supervise the part-time bookkeeper to ensure quality and consistency of accounting work.

More often than not, most businesses would seek to train and add the bookkeeping responsibility to an existing employee in the company in a bid to cut costs. While this may seem to be a good alternative to hiring a part-time bookkeeper, it can backfire if the employee’s bookkeeping work is not up to the quality required by accounting standards. This can potentially have a damaging financial effect on the business as a whole in the long run.

How Much Does It Cost to Hire A Full-Time Bookkeeper for Your Small-Scale to Medium-Sized Business?

On average, depending on experience and location, a typical full-time bookkeeper would demand a salary ranging from £25,000 to £45,000 a year plus perks from a business. In recent statistics posted by job search site, Glassdoor.com, it is revealed that full-time bookkeepers command a handsome pay package of close to £70,000 in large cities where the cost of living is among the highest in the world. Employers are also expected to add a further 20% to the salary packages for employee benefits afforded to full-time bookkeepers, such as dental care plan, child care, fitness, retirement plans and office workspace.

If making sure your business’ accounts are in order and constantly updated is fundamental to the financial success of your business, then hiring a full-time bookkeeping professional could very well prove to be a shrewd move. The full-time bookkeeper will essentially perform day to day management of accounts, paying and sending out invoices, managing accounts receivable, processing payroll as well as preparing monthly financial statements. However, as with working with a part-time bookkeeper, the management of the company has to watch over the full-time bookkeeper to ensure the quality of accounting work delivered is of the required standards.

Learn more about small business accounting costs and payroll costs.

What is the Cost of Procuring Outsourced Bookkeeping Service for Your Small-Scale to Medium-Sized Business?

If you have decided that outsourcing your business’ bookkeeping operations makes perfect financial sense at this point for your business, then it is time to look at the cost of procuring the services of an outsourced bookkeeper. The price you would have to fork out for an outsourced full-time bookkeeping service depends on the number of business dealings the company conducts as well as how varied the accounting service would be but prices can be as low as £500 or as high as £2,500 per month. Outsourcing your bookkeeping function allows you to tailor-make your accounting services to suit your business financial needs. With an outsourced bookkeeping service, your company can employ a more sophisticated management accounting system, which in turn will lead to the creation of a virtual accounting department. This will add to your bookkeeping fees each month but the extra costs will be fully justified as your company heads into the growth phase of the business. In the growth phase, your business must adopt a full-scale accrual-based accounting system as it will help the business to scale through its generation of advanced-level management and financial reports. This level of financial management will not only help your business but also keep key stakeholders of your business such as employees, investors and vendors well-informed of your company’s financial health.

Outsourcing your bookkeeping function can be a viable solution for your company if you decide that internal or part-time/full-time bookkeeping is not the right choice for your business. Understandably, many businesses have their reservations about outsourcing their bookkeeping functions as they do not know how the outsourced accounting service works. But in this day and age, especially with new and improved technologies at our fingertips, outsourced bookkeeping services provide a more sophisticated and cost-effective solution to businesses looking to do away with traditional, in-house bookkeeping.

Many advantages come with an outsourced bookkeeping service, something that is lacking in an internal bookkeeper hired by the business. With many outsourced clerical, auxiliary and administrative bookkeeping support services currently available in the market, a business can acquire each service on an hourly, monthly basis and also tailor-make a bookkeeping service package to align with the company’s financial needs. Implementation of a full-service management accounting system by hiring an outsourced bookkeeper is also a bonus for the company as the execution of this accounting system can help the business scale in the growth stage. Outsourcing your bookkeeping function also means an employee originally in-charge of managing your company’s accounts part-time, can be relieved of bookkeeping duties and instead be moved to a more pivotal business development role, generating more income for the business. This ultimately encourages career growth in your top-performing employees and will give them the motivation to contribute more meaningfully towards the company’s culture and bottom line.

How Do You Decide Which Bookkeeping Option Works Best for Your Business?

While there are pros and cons to every bookkeeping service, ultimately, it is down to you, as part of the company’s management team and/or owner to evaluate your business from a financial standpoint, figuring out the strengths, weaknesses, opportunities and threats to your business’ monetary health before opting for one of the bookkeeping options.

Deciding on When to Acquire Outsourced Bookkeeping Services?

Allow AccountantCosts to be your one-stop-shop for your bookkeeping and accounting needs. We can support your business growth by improving your company’s cash flow and bottom line via our bookkeeping expertise.

If you are looking at financial guidance more broadly than bookkeeping, take a look at our pages on financial advisor costs and wealth manager cost factors to help you make an informed decision.

Get quotes from accounting firms

Save 100's on your yearly accounting by comparing quotes from local companies.